Walmart sales tax calculator

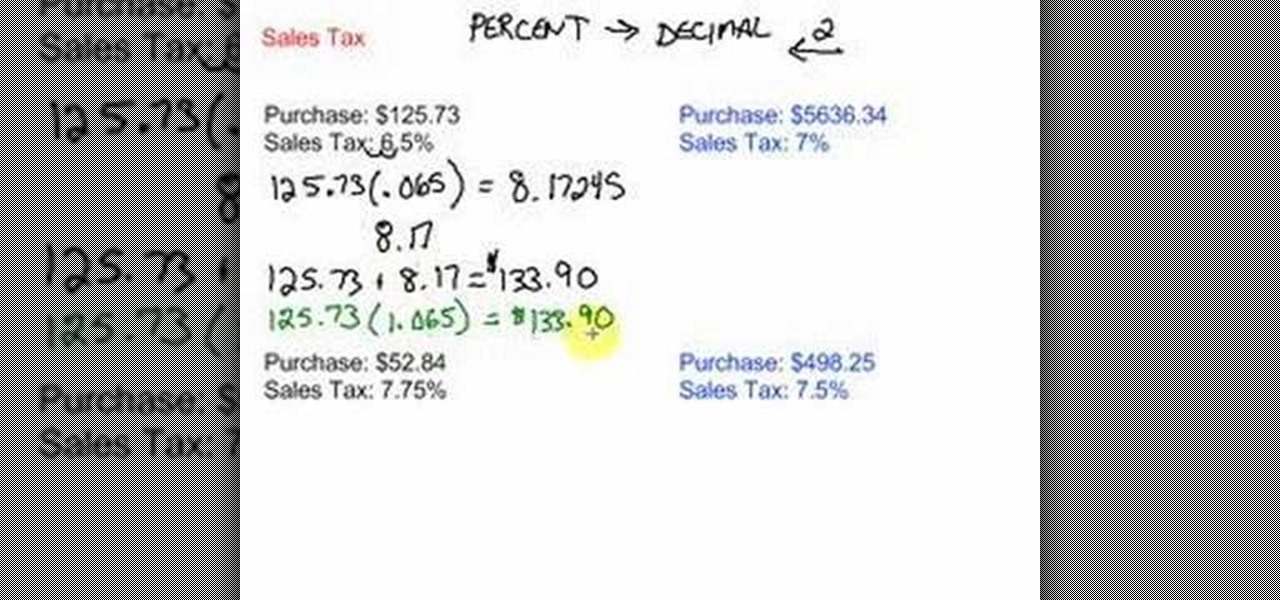

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax. 500 CostPrice before ST.

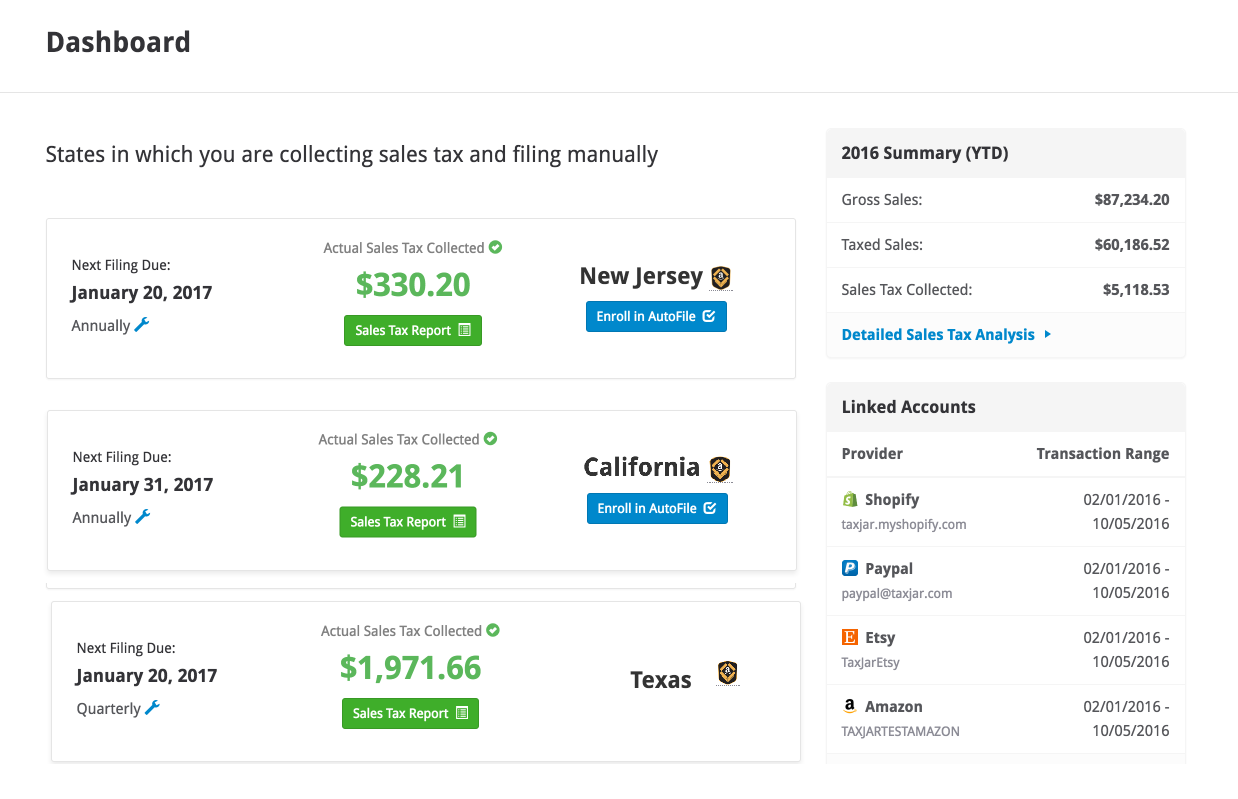

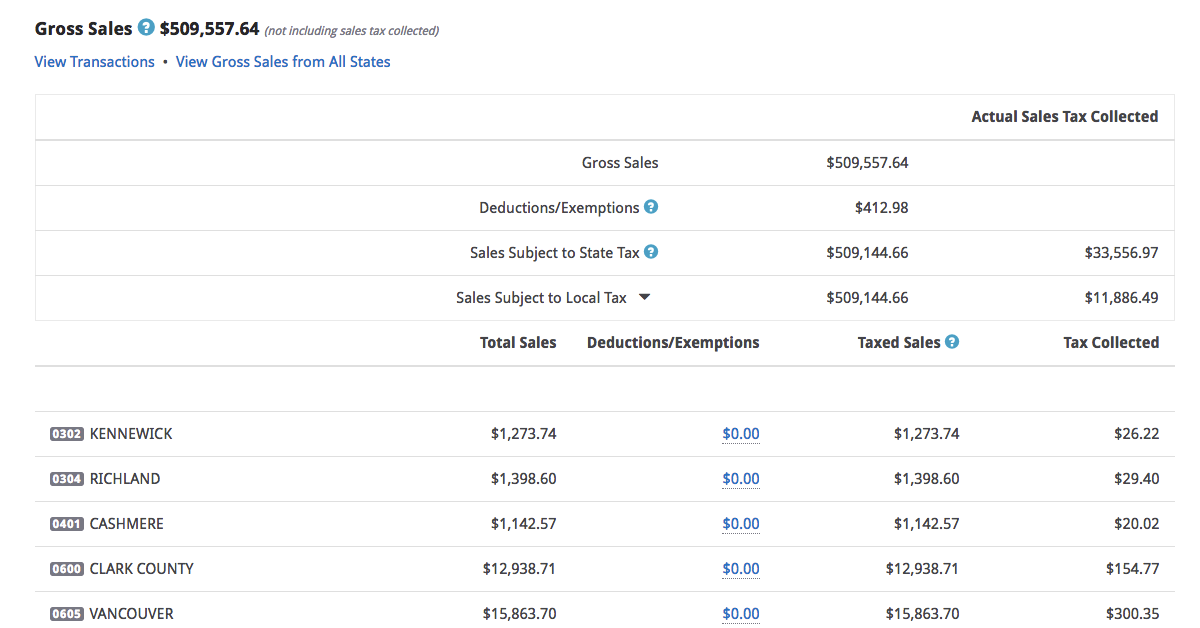

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

10500 In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return.

. The Vermont Illinois Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont Illinois in the USA using average Sales Tax Rates andor specific Tax. Filing and remitting sales tax for your Walmart store has never been easier. Effective Tax Rate for Walmart is calculated as follows.

2022 View and export this data going back to 1970. The current total local sales tax rate in Richmond VT is 6000. The December 2020 total local sales tax rate was also 6000.

10000 Total CostPrice including ST. The average cumulative sales tax rate in Richmond Vermont is 6. Sales Tax Calculator Enter your city and zip code below to find the combined sales tax rate for a location.

Tax Rate is calculated as Tax Expense divided by its Pre-Tax Income. Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures. Thats part of what it costs you.

Download the current Sales Tax Codes for Walmart Marketplace by clicking below. Sales tax - unless you are buying wholesale you may be paying sales tax on your products. Start your Free Trial.

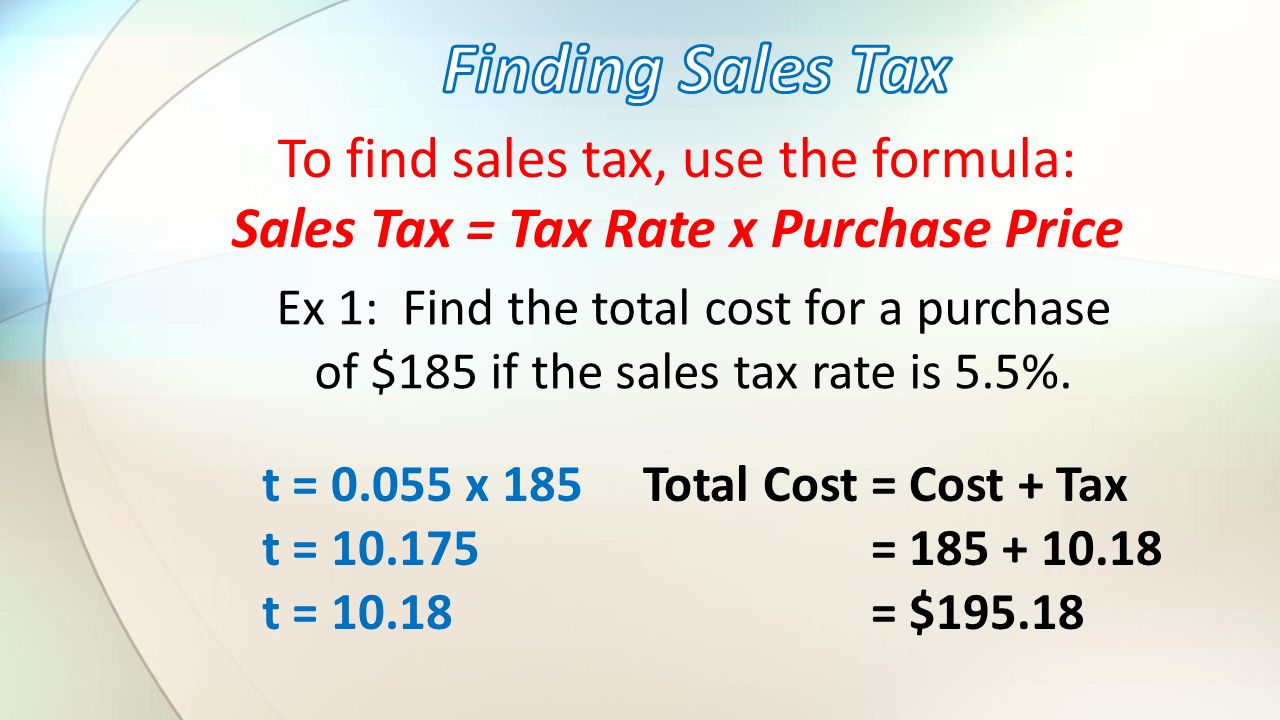

Sales tax is calculated by multiplying the purchase price by the. The price and tax calculation is based on the state of the customer and seller the sales tax policies of the seller and local and state laws. Provision For Taxes 4459 B.

If youd like to calculate sales tax with product exemptions sourcing logic and. The exact amount of tax charged is. 255 divided by 106 6 sales tax 24057 rounded up 1443 tax.

Richmond is located within Chittenden County. More about shipping sales tax codes. For all individual purchases that cost less than 1000 each use the Use Tax Reporting Table below to estimate your use tax.

Youll use this list to complete Item Setup BUT do not need it to. Walmart Tax Rate. Ad Free 2-day Shipping On Millions of Items.

A basic calculator performs the basic calculations. 2253 As of Jul. For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000.

How do you figure out what the sales tax rate is. For individual purchases that cost 1000 or more each. Warehousing costs - If you are paying a fulfillment center fees for.

Sales Tax Calculator Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. The effective tax rate represents the percentage of Earnings Before Tax paid out in taxes. This includes the rates on the state county city and special levels.

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Updated Discount Sales Tax Calculator App For Pc Mac Windows 11 10 8 7 Android Mod Download 2022

Sales Taxes In The United States Wikiwand

Walmart Integration Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures

How To Charge Your Customers The Correct Sales Tax Rates

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Calculate Tax On Purchase Clearance 57 Off Www Ingeniovirtual Com

Sales Tax On Grocery Items Taxjar

Sales Tax Calculator Taxjar

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

How To Calculate California Sales Tax 11 Steps With Pictures